accumulated earnings tax c corporation

Understanding The Accumulated Earnings Tax Before Switching To A C Corporation In 2019

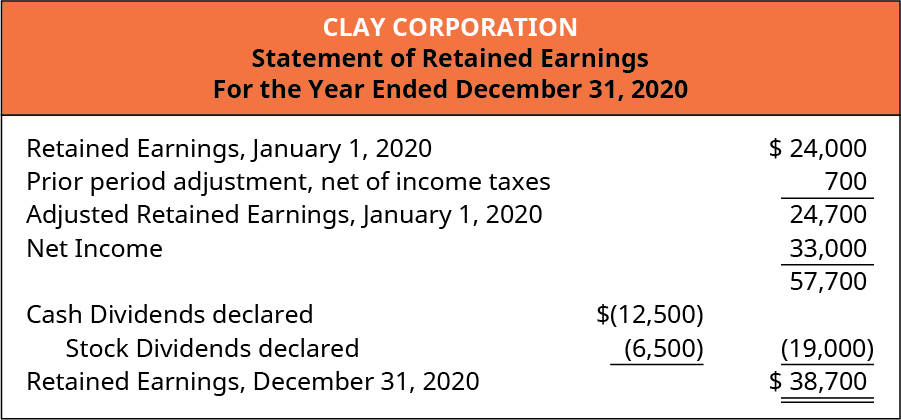

Compare And Contrast Owners Equity Versus Retained Earnings Principles Of Accounting Volume 1 Financial Accounting

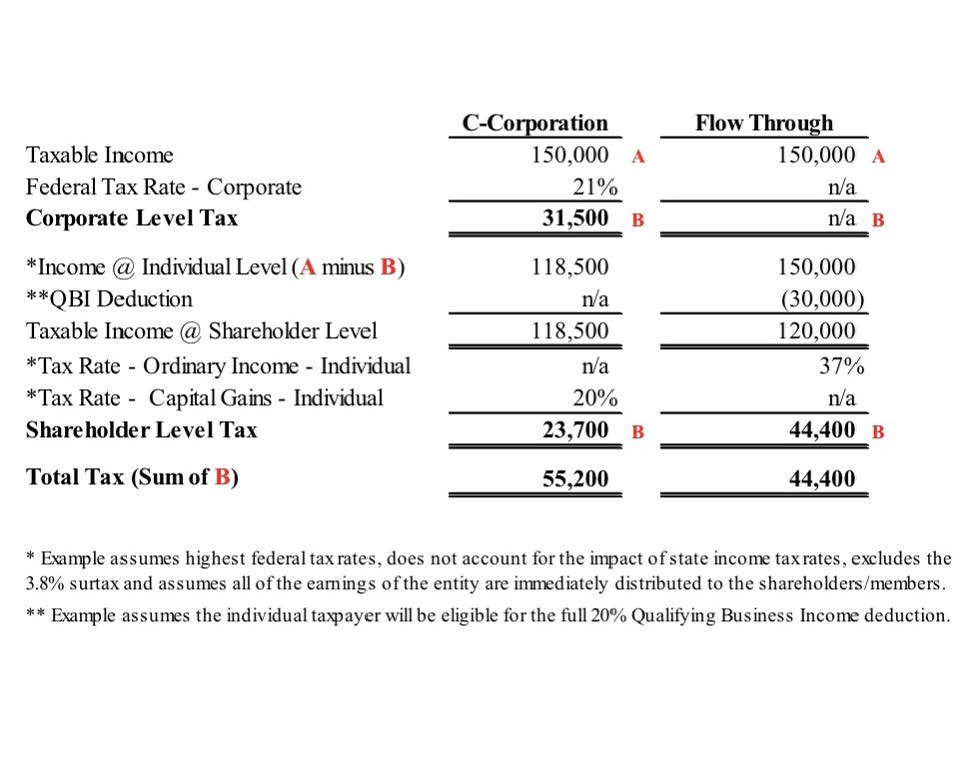

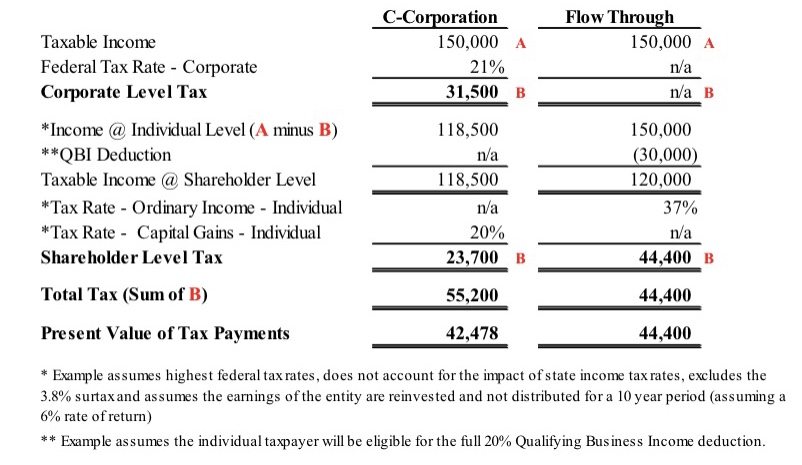

Tax Treatment For C Corporations And S Corporations Under The Tax Cuts And Jobs Act Smith And Howard Cpa

Tax Treatment For C Corporations And S Corporations Under The Tax Cuts And Jobs Act Smith And Howard Cpa

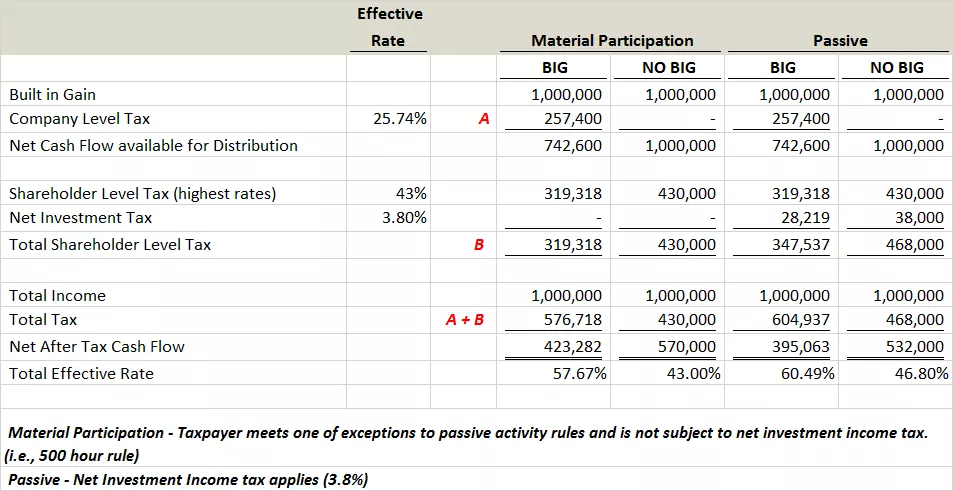

Significant Cuts To The Corporate Tax Rate Is It More Beneficial To Be A C Corporation Now Bernard Robinson Company

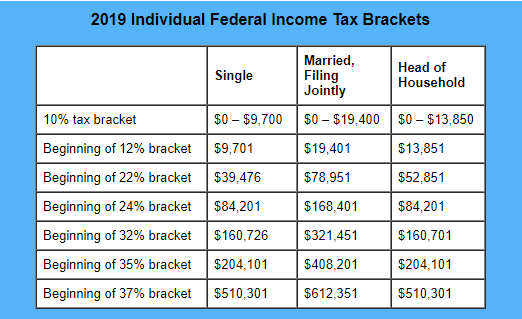

Low Tax Rates Provide Opportunity To Cash Out With Dividends

Earnings And Profits Computation Case Study

Solved The Sky Blue Corporation Has The Following Adjusted Chegg Com

Earnings And Profits Computation Case Study

Demystifying Irc Section 965 Math The Cpa Journal

Oh How The Tables May Turn C To S Conversion Considerations Stout

Earnings And Profits Computation Case Study

Oh How The Tables May Turn C To S Conversion Considerations Stout

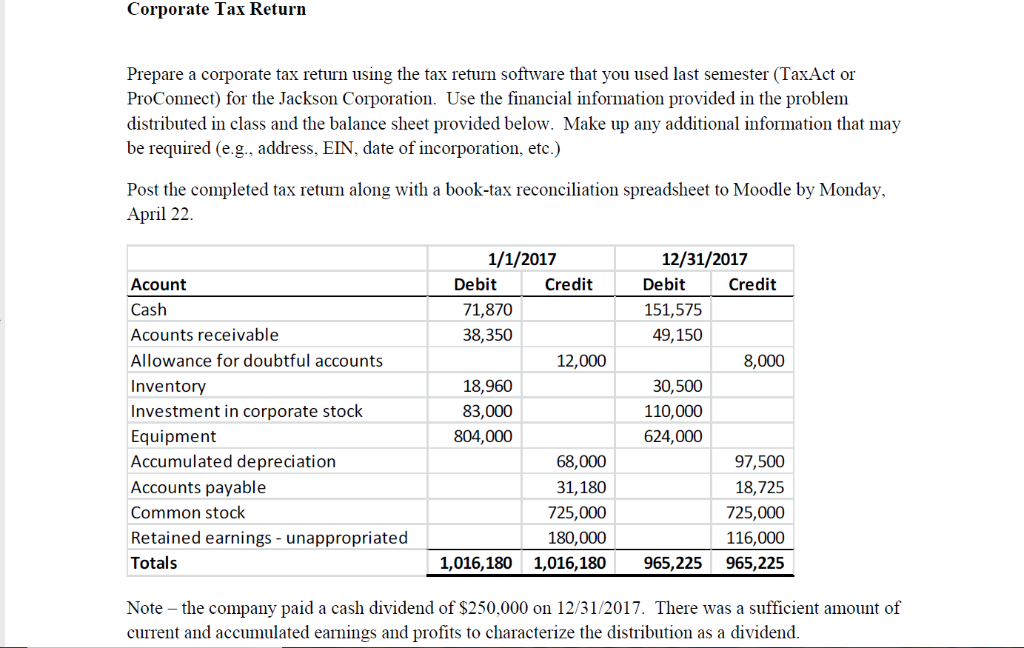

Corporate Tax Retur Prepare A Corporate Tax Return Chegg Com

What Are Accumulated Earnings Definition Meaning Example

Income Tax Computation Corporate Taxpayer 1 2 What Is A Corporation Corporation Is An Artificial Being Created By Law Having The Rights Of Succession Ppt Download

Significant Cuts To The Corporate Tax Rate Is It More Beneficial To Be A C Corporation Now Bernard Robinson Company